ATTENTION EMPLOYERS

Don't miss out on the largest government stimulus program in history!

ATTENTION BUSINESS OWNERS

Don't miss out on the largest government stimulus program in history!

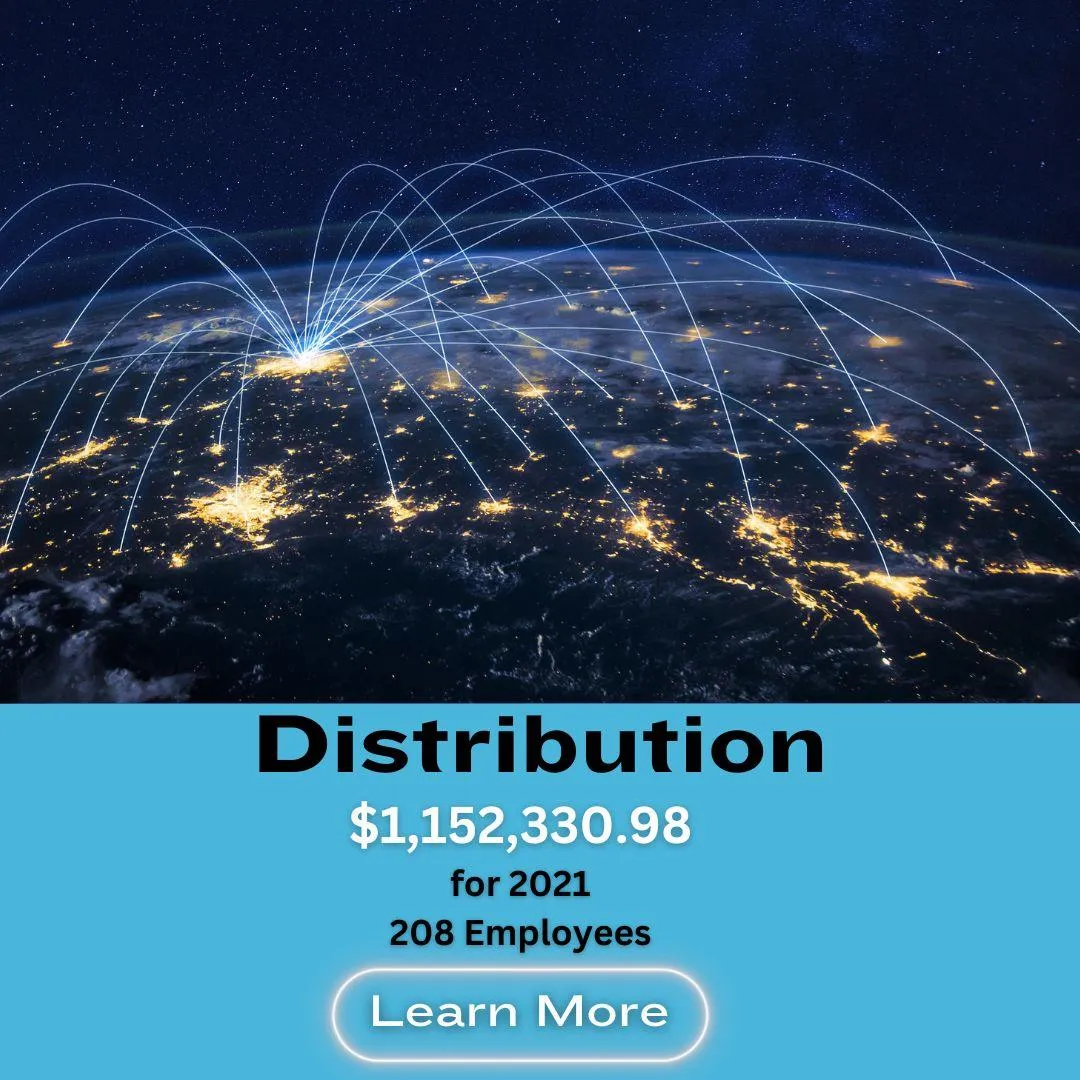

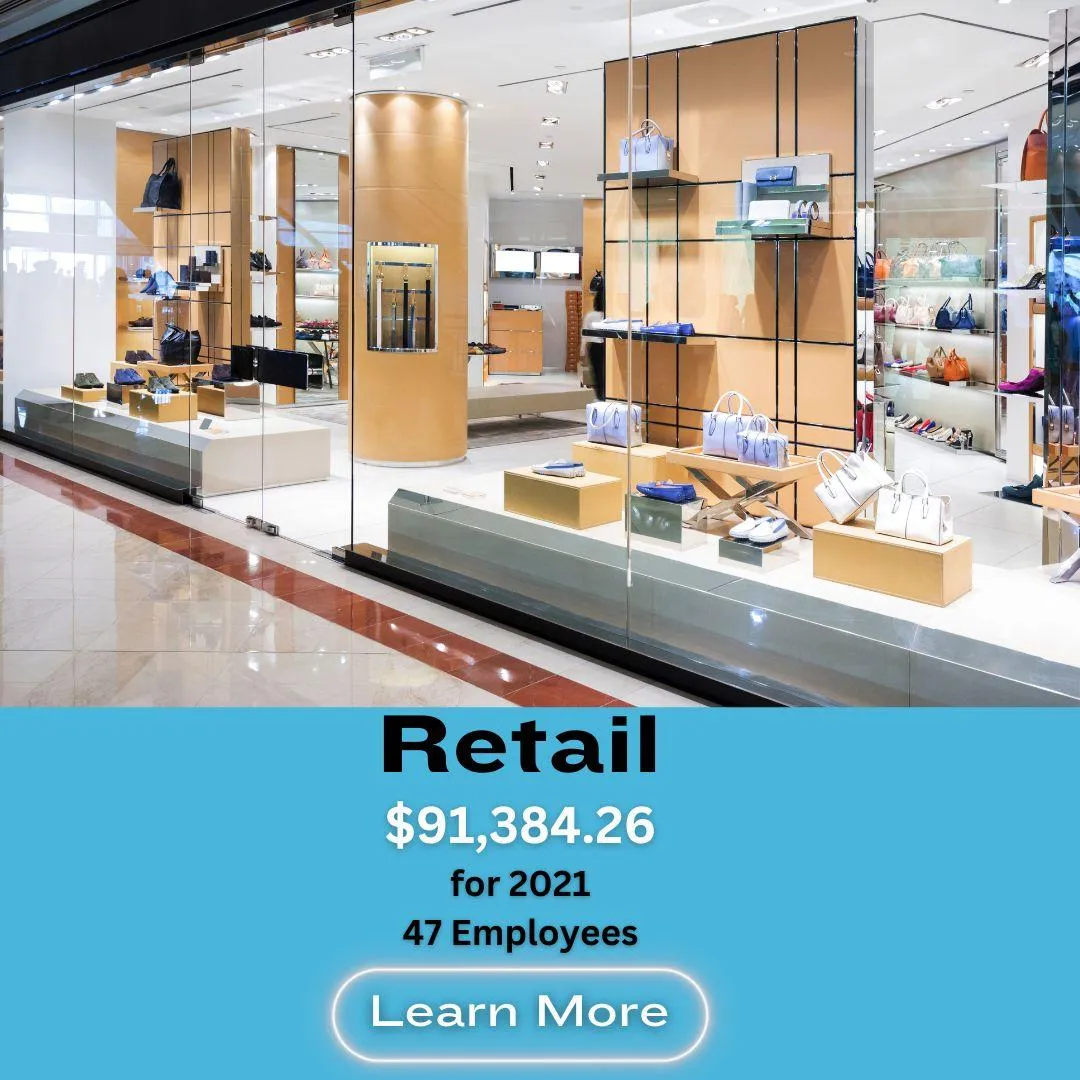

ERC Success Stories

Who You Choose To Work With Is VITAL

In the past, the Employee Retention (tax) Credit program was relatively unknown. However, the situation has changed significantly, and now most business owners are at least familiar with it. As a result, a growing number of our applicants are actively seeking assistance from multiple consultants to maximize their claims. This raises an important question:

What sets our partners apart from the rest?

Expertise and Knowledge:

Trusted partners, such as reputable accounting firms or tax professionals, possess in-depth knowledge and expertise in navigating complex tax regulations and requirements. They are familiar with the specific guidelines and documentation necessary for claiming the ERC accurately. Their experience and understanding can help ensure that you maximize your credit eligibility while avoiding errors or oversights that could lead to penalties or delays.

Compliance and Accuracy:

Applying for the ERC involves understanding intricate eligibility criteria, calculating qualified wages, and completing proper documentation. A trusted partner can assist you in determining your eligibility, ensuring you meet all necessary requirements, and accurately calculating your credit amount. Their attention to detail helps minimize the risk of errors or omissions in your application, reducing the likelihood of audits or inquiries from tax authorities.

Timeliness and Efficiency:

ERC applications often have strict deadlines, and delays or mistakes can lead to missed opportunities or financial losses. By working with a trusted partner, you can benefit from their ability to efficiently gather and organize the required information, complete the necessary paperwork, and submit your application promptly. Their expertise in handling such processes can help expedite the application and increase the chances of receiving the credit in a timely manner.

Ongoing Support and Guidance:

Trusted partners not only assist with the initial application process but also offer ongoing support and guidance. They can provide insights on how to structure your employee retention strategies, optimize your tax credits, and adapt to any changes or updates in the ERC program. This ongoing partnership can help you stay informed, compliant, and maximize your benefits throughout the eligibility period.

In the past, the Employee Retention (tax) Credit program was relatively unknown. However, the situation has changed significantly, and now most business owners are at least familiar with it. As a result, a growing number of our applicants are actively seeking assistance from multiple consultants to maximize their claims. This raises an important question: What sets our partners apart from the rest?

Expertise and Knowledge:

Trusted partners, such as reputable accounting firms or tax professionals, possess in-depth knowledge and expertise in navigating complex tax regulations and requirements. They are familiar with the specific guidelines and documentation necessary for claiming the ERC accurately. Their experience and understanding can help ensure that you maximize your credit eligibility while avoiding errors or oversights that could lead to penalties or delays.

Compliance and Accuracy:

Applying for the ERC involves understanding intricate eligibility criteria, calculating qualified wages, and completing proper documentation. A trusted partner can assist you in determining your eligibility, ensuring you meet all necessary requirements, and accurately calculating your credit amount. Their attention to detail helps minimize the risk of errors or omissions in your application, reducing the likelihood of audits or inquiries from tax authorities.

Timeliness and Efficiency:

ERC applications often have strict deadlines, and delays or mistakes can lead to missed opportunities or financial losses. By working with a trusted partner, you can benefit from their ability to efficiently gather and organize the required information, complete the necessary paperwork, and submit your application promptly. Their expertise in handling such processes can help expedite the application and increase the chances of receiving the credit in a timely manner.

Ongoing Support and Guidance:

Trusted partners not only assist with the initial application process but also offer ongoing support and guidance. They can provide insights on how to structure your employee retention strategies, optimize your tax credits, and adapt to any changes or updates in the ERC program. This ongoing partnership can help you stay informed, compliant, and maximize your benefits throughout the eligibility period.

We Are Here To Help

No Upfront Cost

Full IRS Compliance

Account Manager

Proven Track Record

No Upfront Cost

No cost, no obligation eligibility analysis. Only pay when you collect. Apply. Wait. Get Paid.

Full IRS Compliance

Save time and avoid headaches. Get a free consultation with an ERC pro, the right way.

Account Manager

The ERC program is complicated. A dedicated specialist will guide you through the whole process.

Proven Track Record

With thousands of successful applications, we know how to get you the max credit amount you deserve.

Limited Time Only

Don't miss out on the valuable federal

assistance your business could

be eligible for!

What Clients Say About Us

"This was actually my second attempt at applying for the ERC credit. The first time I went with another company, and it turned out to be a complete nightmare. Then, a friend of mine recommended Loyalty Link. From the very beginning, the process was seamless and straightforward. They swiftly connected me with a dedicated specialist partner who was highly knowledgeable and promptly addressed any questions or concerns I had. The best part is that my business qualified and received over $137,000! I couldn't be more thankful for Loyalty Link's support."

Kayla Johnson

"Loyalty Link's service was truly amazing and the process was a breeze. They paired me with an exceptional and reputable ERC specialist who guided me every step of the way and promptly addressed all of our questions and concerns. A top-notch experience! Highly recommend their ERC services."

Jason Chang

Frequently Asked Questions

What is ERC?

The Employee Retention Credit (ERC) is a payroll tax refund from the United States Treasury Department applicable to businesses who kept employees on payroll during the pandemic. You may be eligible to qualify

Will my business still qualify if I received a PPP Loan?

ERC eligibility was expanded and extended as part of the Consolidated Appropriations (CARES) Act, 2021 to include employers who received loans under the Paycheck Protection Program (PPP), along with those who did not. Now, you may be able to claim an ERC credit. If your business experienced a decline in total receipts in 2020 and/or 2021, but you retained your employees, you may be able to secure your payroll tax refund through our trusted partners.

Why isn't my bank or CPA telling me about this?

Bankers, CPAs, and Financial Advisors are well-versed in dealing with the SBA and were instrumental in assisting with PPP funds. The SBA incentivized banks by covering administrative fees for PPP loans, motivating them to guide clients through the program efficiently. Contrarily, handling the complex ERTC program isn't within their scope, and involvement in employment tax compliance poses liability risks. It's crucial to consider these distinctions as clients found themselves eligible for substantial funds after being wrongly advised by their CPAs due to revenue-focused perspectives. Our partners are experts in the ERC tax credit field who's sole focus is on ERC and properly getting you the money you deserve.

How do I know if my business qualifies?

To determine if your business qualifies for the ERC program, consider the following criteria: The IRS estimates that around 70-80% of small to medium-sized businesses (SMBs) are eligible for this credit. If your business has faced disruptions to commerce, travel, or group meetings due to government orders, there's a good chance it might qualify! This includes instances of supply chain disruptions, price increases, reduced operating hours, a decrease in goods or services offered, or if you were unable to travel or attend conventions.

For a more accurate assessment tailored to your specific circumstances, just simply complete our pre-qualification form and you will then be connected with one of our partners trusted ERC specialists that will guide you step by step through the complete application process and answer any questions or concerns you may have. The ERC program is only available for a limited time so don't hesitate to reach out and discover how the ERC program can benefit your business!

What clients say about us

"This was actually my second attempt at applying for the ERC credit. The first time I went with another company, and it turned out to be a complete nightmare. Then, a friend of mine recommended Loyalty Link. From the very beginning, the process was seamless and straightforward. They swiftly connected me with a dedicated specialist partner who was highly knowledgeable and promptly addressed any questions or concerns I had. The best part is that my business qualified and received over $137,000! I couldn't be more thankful for Loyalty Link's support."

Kayla Johnson

"Loyalty Link's service was truly amazing and the process was a breeze. They paired me with an exceptional and reputable ERC specialist who guided me every step of the way and promptly addressed all of our questions and concerns. A top-notch experience! Highly recommend their ERC services."

Jason Chang

DON'T MISS OUT!

The ERC Program is Only Available For a Limited Time, Let Us Partner You With

a Dedicated Support Specialists Today.

Get the COVID-19 Relief Money YOU Deserve!

Loyalty Link prides itself in being a trusted ERC liaison, pairing small businesses with a dedicated ERC specialist to create a seamless ERC application experience from start to finish. Created by small business, for small business.

Quick Links

About Us

Services

Contact Us

Copyright 2022 . All rights reserved.

don't miss out!

The ERC Program is Only Available For a Limited Time,

Let Us Partner You With a Dedicated Support Specialists Today.

Get the COVID-19 Relief Money YOU Deserve!

Loyalty Link prides itself in being a trusted ERC liaison, pairing small businesses with a dedicated ERC specialist to create a seamless ERC application experience from start to finish. Created by small business, for small business.